|

| Courtesy of: Manila Bulletin |

NOTE: Tax For Every Juan (TFEJ) will run a series of commentaries on significant proposed tax reform measures submitted to Congress. This is to contribute to the country's tax reform discussion and enable ordinary taxpayers to understand more what is being proposed and how it will impact them when passed into law. First among these would be the DOF Tax Reform Proposals, which will come in several packages.

The Department of Finance submitted to the House of Representatives last September 26, 2016 the package one of its proposed tax reform measures, which it has called 'Tax Reform for Acceleration and Inclusion."

The proposed measures in draft bill format covers the following taxes:

- Personal Income Tax (PIT)

- Value Added Tax (VAT)

- Excise Tax

This post will tackle the most anticipated part of the package -- the proposed new PIT brackets.

Salient features of the change in PIT bracket proposals are as follows:

- 1st P250,000 income is tax-exempt. The following exemptions are deleted to simplify tax compliance and aministration:

- P50,000 personal exemption;

- P25,000 additional exemption for each dependent (up to a maximum of 4);

- tax-exempt bonuses and other income up to P82,000; and

- tax-exemption for minimum wage earners (MWEs).

- Lowest statutory tax rate starts at 20%. Highest statutory tax rate of 35% kicks in for income over P5,000,000.

- Proposed timing for 1st phase is 2017. Statutory tax rates will be lowered starting 2018, with 15% being the lowest.

- Taxable income values will be indexed to inflation once every five (5) years based on the 5-year cumulative inflation rate.

WILL THE PROPOSED CHANGE IN PIT BRACKETS EQUITABLY RE-DISTRIBUTE IN A PROGRESSIVE MANNER THE TAX BURDEN AMONG INDIVIDUAL TAXPAYERS?

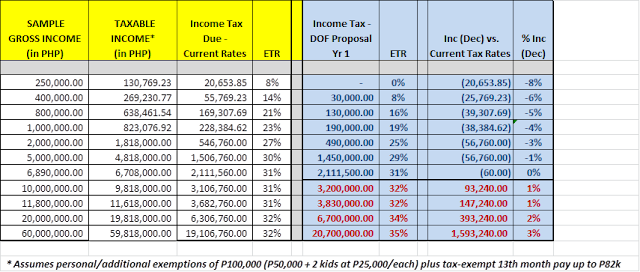

A close look at the resulting effective tax rates (i.e., tax divided by gross income) for taxpayers with different levels of income would show the following:

1st Year: 2018

- Highest drop in ETR (at 8%) will be felt by those with income P250,000 and below.

- Those with income up to about P6.9M will have reduced or no change in tax burden, compared to the current tax system.

- 25% ETR is computed at P2M level.

- 5M income level has ETR of 29%, or a 1% drop from current ETR.

- 35% ETR kicks in for those with income of about P60M.

2nd Year: 2019

- Highest drop in ETR of 8% will extend to those with income up to P1M.

- Those with income up to about P11.8M will have reduced or no change in tax burden, compared to the current tax system.

- 2M income has 20% ETR for Year 2. Down by 5% from initial year. This income level has the biggest drop among the sample gross income.

- 26% ETR is computed at P5M level.

- 35% ETR kicks in for those with income of about P90M (not shown anymore).

Based on the above simulations, it would appear that many individual taxpayers, especially the low and middle-income salaried workers, will benefit from the DOF proposal. Even upper middle-income taxpayers will benefit from the proposal, especially when the rates are further lowered on the 2nd year.

While the reduction in taxes would not seem to be that significant (i.e., no double-digit reduction from the current ETR), the extent of taxpayers to be covered by this tax reform measure is a good indicator of the DOF's attempt to broaden the impact of tax reform while, being prudent with the resulting revenue loss from the tax cut. The phasing of the tax rate cuts into two (2) years will also enable the Government to transition its fiscal position.

However, the proposed changes in tax brackets can be further improved on the following areas to address the issues of equity and progressivity:

TIMING

Since the tax brackets have remained unchanged, at the very least, for 20 years, delaying the effectivity of the new tax table implementing the tax cuts will continue to deny tax justice for the low and middle-income salaried workers, who have been bearing the tax burden among individual taxpayers. The reform is something that was needed yesterday. Thus, the earlier it is implemented, the better.

If the DOF is concerned with immediately contending with revenue loss on the proposed PIT cuts, then it can soften the blow by having an interim solution -- that is, to simply index to inflation the current PIT table, without effecting any reduction in tax rates yet.

As last proposed by the Tax Management Association of the Philippines (TMAP) and some legislators, this would mean adjusting the top income threshold subject to the maximum 32% rate from P500,000 to about P1.1M. Except for the change in tax table, this would entail no other change to the existing tax system. This interim proposal is estimated to result to ETR reduction for most low and middle-income taxpayers of about 4% to 6%, depending on the income level.

Per estimates released by the DOF in the previous administration, this simple indexation proposal would result to around P30B to P60B in revenue losses. Assuming we take even the higher range of estimated loss of P60B, this will be a lot less than the P170B+ the DOF is prepared to lose under the package come 2018.

Thus, it will be best if the DOF introduces a separate bill indexing the current tax table to inflation and make it effective come January 1, 2017.

BROADENING THE TAX BASE

Except for the lowering of tax rates, there is nothing in the draft bill that introduces changes in the way self-employed and professionals (SEPs) are taxed that will help broaden the very narrow tax base.

To aggravate the situation, the top statutory rate is even increased to 35% at the P5M income level and the rate for Optional Standard Deduction (OSD), which is meant to simplify tax compliance and administration, is even lowered from 40% to 20%. These two features of the draft bill will not encourage SEPs in changing their behavior.

35% Top Statutory Rate

The following are some reasons to consider lowering the proposed 35% top statutory rate:

1) While per DOF, only about 6,000 taxpayers are affected by the increase in tax rate, this does not yet consider the potential number of additional taxpayers (mostly SEPs) that are currently not paying the correct amount of taxes. Lowering the top statutory rate will help encourage them to declare more income; thus broadening the tax base.

2) Given that the Corporate Income Tax (CIT) rate is proposed to be lowered to 25%, a 10% variance against the PIT rate appears to be significantly wide. There is a need to close the gap so that taxpayers are indifferent as to whether they remain sole proprietors or decide to incorporate.

3) The DOF proposes the 35% tax rate for the ultra-rich. However, the P5M income threshold appears to be low in order for one to be considered ultra-rich. Meanwhile, efforts to tax the ultra-rich will be more effective if done through capital or wealth taxes, rather than the PIT. The most that the PIT can capture are high-income salaried executives, who are not necessarily the ultra-rich.

Thus, the DOF may consider lowering the top PIT rate to 30%. This is still 5% higher than the corporate tax rate but, the gap is no longer too wide. The 2% tax cut in the top statutory rate will also contribute to greater perception that the PIT system is now more fair and equitable; thereby, encouraging more SEPs to be part of the system.

OSD Rate

Reducing the OSD rate from 40% to 20% means lesser incentive to avail of the OSD option. This will encourage individual taxpayers, instead, to use the itemized deduction method to minimize their tax liabilities.

Instead of doing this, the DOF can choose to promote more the OSD option in order to help SEPs simplify their tax compliance and for the BIR to simplify tax administration. Aside from retaining the OSD rate at 40% or maybe just lowering it to about 30% due to the tax rate cuts, the DOF can prescribe OSD as the default method for individual taxpayers, with the itemized method being the exception.

Once availed, the following benefits may be given to taxpayers using the OSD method:

- No need for audited financial statements;

- Simplified bookkeeping and invoicing requirements (except if VAT-registered);

- Express lane for BIR taxpayer service; and

CONCLUSION

The DOF proposed tax brackets, which effectively lower the tax burden over a period of two years starting 2018, will benefit many of the salaried taxpayers, who are currently bearing the brunt of the tax burden.

However, the DOF may have to consider providing immediate tax relief to address the long-standing issue of bracket creep. This can be done by introducing an interim solution of indexing the current tax tables while, the various tax reform packages are being discussed.

The other alternative is for the DOF to implement the revised tax brackets come taxable year 2017, simultaneous with the implementation of the proposed increase in excise taxes and removal of certain VAT exemptions.

Meanwhile, the DOF may also have to reconsider lowering the top statutory tax rate from 35% to 30% in order to broaden the tax base and remove an unintended tax incentive for self-employed to incorporate.

Lastly, the DOF has to maintain the OSD rate at 40% or at the most, reduce it to 30%, in order to encourage SEPs to use this deduction method. Making the OSD a default method and providing incentives for its use will help attain simplification and contribute to broadening the tax base.