Image credits: Interaksyon.com

It has been sometime since this personal blog on taxes was updated. Thought it would be confusing to discuss the different versions of the tax reform bill until it was clear what the likely outcome would be.

There were various versions filed in the House of Representatives before they came out with a committee report that was later on approved by the Lower House and endorsed to the Senate. In the Senate, its various bills metamorphosed into its own committee report that was much different from that of the Lower House version. And true enough, up until the Bicam, the bill that was endorsed to both houses of Congress for approval still contained some new provisions.

TRAIN is the current Government's first attempt to reform the country's tax system. Under its declaration of policy, it is meant to enhance the progressivity of the tax system, provide as much as possible equitable relief to a greater number of taxpayers and their families, and ensure that the Government is able to provide for the needs of the people.

So how did the final TRAIN Law look like and measure up to these objectives? There were hits and misses.

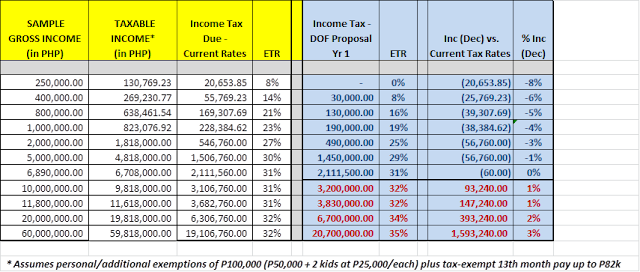

The reduction of personal income tax rates and updating of the individual income tax table is a done deal from the very start. As early as 2014, tax advocates, like the Tax Management Association of the Philippines (TMAP), had long pointed out the need to adjust the tax table to address the bracket creep issue and reduce the tax rates to make us competitive within the ASEAN region. It is something that our Government owes to the working class. Thus, its passage under the TRAIN, while much welcome after the long wait, was something that people had expected as a matter of course.

So what went right with the TRAIN?

HIT #1: Simplification of Tax System for Self-employed and Professionals (SEPs)

The option to avail of 8% flat tax for SEPs with gross sales/receipts below P3M is one step to encouraging tax compliance from this sector. Making it lieu of income tax and 3% percentage tax is already good incentive. We should hold them accountable and report them to the BIR if they still fail to comply,

Meanwhile, moving the tax deadlines for individual income tax filers by a month later for the 1st quarter is also much welcome. This way, individuals will no longer have an excuse for late quarterly ITR filing since this deadline would no longer coincide with the annual ITR filing deadline.

HIT #2: Single Tax Rate for Property Transfers

Under TRAIN, transfer of properties will be subject to a tax rate of 6%, regardless of the mode of transfer -- be it via sale, donation or as part of the estate. This way, people need not think of ways to try to minimize or avoid tax payment on these transfers.

In fact, the most tax-efficient mode of transfer under the TRAIN will be via the estate -- i.e., simply allowing properties to be transferred at the time of death rather than pro-actively doing something about it beforehand. This is because of some generous deductions allowed in computing the net estate, which will practically protect low and middle class families from this tax.

HIT #3: Taxpayer-friendly Administrative Provisions

TRAIN has several provisions that aims to ease compliance requirements -- e.g., audited FS requirement, ITR form pages, VAT registration, invoice/receipt issuance.

It also settled some contentious taxpayer issues, which arose during the previous BIR administration -- e.g., interest on interest, VAT on tax-free exchanges, donor's tax on business transactions, VAT on condominium and association dues.

Even with these hits, TRAIN could have been a much, much better law if not for these misses.

MISS #1: Continued/Expanded VAT Exemptions

The removal of numerous VAT exemptions was needed to widen the VAT base and make the VAT system more efficient (i.e., avoid leakages).

While TRAIN repealed the VAT exemption privilege of a good number of specific entities, it failed to remove or limit the VAT exemption of broad sectors, such cooperatives and real estate.

What's worse, it even provided for additional VAT exemption on the sale of drugs and medicines prescribed for diabetes, high cholesterol and hypertension starting January 1, 2019. This runs counter to the principle of providing for Government support and subsidy directly to intended recipients rather than using the tax system to dispense blanket subsidies to everyone, including the rich, that are hard to account for later on.

MISS #2: Regressive New Auto Excise Tax Rates

The imposition of higher excise tax rates was meant to generate more revenues from the purchase of automobiles.

Under the current system, the rates are graduated based on the net manufacturer's price or importer's selling price. It is a progressive tax system since the more expensive the car, the higher the taxes one has to pay.

Unfortunately, under TRAIN, the top statutory tax rate for luxury cars was reduced from 60% to 50%. Thus, the most expensive cars will actually pay lower taxes under the TRAIN compared with the old tax system. Simply unbelievable! With this, the burden of higher auto excise taxes will be shouldered by lower and mid-range priced cars, which is utterly regressive.

Meanwhile, instead of graduated tax rates, TRAIN imposed fixed tax rates. Thus, there are some distortions on the taxes to be paid as the price transitions from lower to the higher tier.

MISS #3: Missing Indexation Provisions

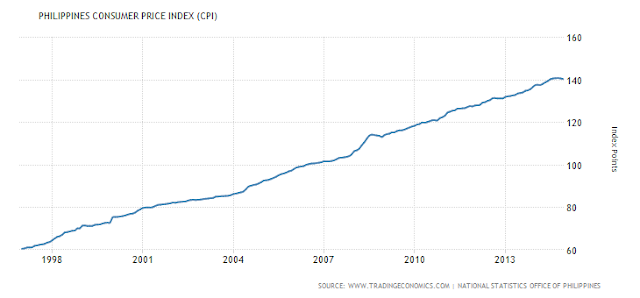

The initial TRAIN draft bills had various indexation provisions all over the place. This is to ensure that the peso values indicated in the Tax Code gets to be automatically updated for inflation, without need for Congress to legislate it. It was a painful lesson learned from the personal income tax table, which got stuck with old tax bases subject to high tax rates that facilitated the bracket creep over the years.

When the final TRAIN law was signed, all the indexation provisions were suddenly gone. While the law provided for some changes in tax rates in 5 years time, tax bases will still remain the same. Hopefully it would not take us another 20 years or so to address this important item.

MISS #4: Preferential Tax Rate for ROHQ Qualified Employees

Under the TRAIN bill that was passed by legislators, it was provided that existing ROHQs, OBUs and petroleum service sub/contractors will continue to avail of the preferential tax rate for their qualified ROHQ employees. Meanwhile, all newly-registered entities by January 1, 2018 shall no longer avail of this preferential treatment.

This provision runs counter to the principle of equity wherein those with the same ability to pay taxes should pay the same amount of taxes. To be fair with employees of entities that were granted this incentive and other individual taxpayers, legislators could have provided for a sunset provision to facilitate transition until they eventually become subject to the regular tax system.

When the bill was sent to the President for signing, this provision was among the items he vetoed. Unfortunately, however, there seems to be some legal question on the effect of the veto -- on whether existing entities can no longer avail of the preferential tax rate as the President intended or will it simply be back to status quo considering the way that the provision was crafted into the law. People are now awaiting the DOF implementing regulations regarding this matter.

MISS #5: "Surprise Taxes" without Public Consultation

There were several new tax provisions included in TRAIN, which were not part of the bill approved by the Lower House that was subject to extensive public hearings. These include the doubling of DST rates, tax on cosmetic procedures, and increases in tax rates for sale of shares of stocks, coal and tobacco taxes.

While we understand that the Senate and Bicam were looking for additional sources of revenues, there were no in-depth studies on the impact of these "surprise taxes." There was also lack of consultation with affected groups.

What's the Verdict?

Success can be best measured against its set objectives.

While TRAIN has made some inroads in progressivity and equity, particularly for the personal income tax system, a lot still needs to be done in VAT and excise tax systems to ensure that are tax laws are not mangled by legislators and derailed by special interests. We should hold our legislators accountable and remain vigilant so that we do not experience the same in the subsequent tax reform packages.

While TRAIN will be able to raise much-needed revenues, Government must ensure that collections are maximized from those who have the ability to pay the tax, particularly the SEPs and the rich. Now that we have a more taxpayer-friendly tax law, those who refused to pay taxes before no longer have an excuse not to pay them this time. The Government must do its job in gathering taxpayer data and smartly analyzing them in order to check if they properly report and pay their taxes. Government must also enforce the necessary penalties in cases of non-compliance.

On the other hand, the impact on the poorest of the poor -- i.e., those who did not benefit from the reduction in personal income taxes but had to share in the increase in consumption taxes, must be sufficiently protected by the Government. This must be done through proper implementation of social welfare programs identified under the TRAIN Law, such as the pasada vouchers, unconditional cash transfers and the like. We must hold the Government accountable in ensuring that these programs reach their intended beneficiaries and provide whatever necessary support to cushion the impact of the TRAIN Law. Otherwise, TRAIN will be one big failure if the Government forgets to protect this hardest hit sector.

On the other hand, the impact on the poorest of the poor -- i.e., those who did not benefit from the reduction in personal income taxes but had to share in the increase in consumption taxes, must be sufficiently protected by the Government. This must be done through proper implementation of social welfare programs identified under the TRAIN Law, such as the pasada vouchers, unconditional cash transfers and the like. We must hold the Government accountable in ensuring that these programs reach their intended beneficiaries and provide whatever necessary support to cushion the impact of the TRAIN Law. Otherwise, TRAIN will be one big failure if the Government forgets to protect this hardest hit sector.

Philippine tax reform still has a long way to go. TRAIN is just the first station along its journey. It may not exactly be where we would have wanted it to go. It could have done a whole lot more in reforming our tax system.

But, with the next stations ahead, let us remain vigilant and actively participate, whenever we can, along the way so that we, as one Filipino nation, will reach our end-destination -- a tax system that is truly fair, simple and just.

But, with the next stations ahead, let us remain vigilant and actively participate, whenever we can, along the way so that we, as one Filipino nation, will reach our end-destination -- a tax system that is truly fair, simple and just.