Happy New Year, fellow Taxpayers!

At the start of 2016, it is good to reflect and draw up a list of our aspirations as Filipino taxpayers for this New Year. This list is something that we can all share with other taxpayers and demand from our Government, both from the current administration and the candidates for the upcoming 2016 elections.

Here's how my wishlist goes!

Wishlist #1: INFLATION-ADJUSTED TAX BRACKETS

This is basic and elementary. Simply a no-brainer.

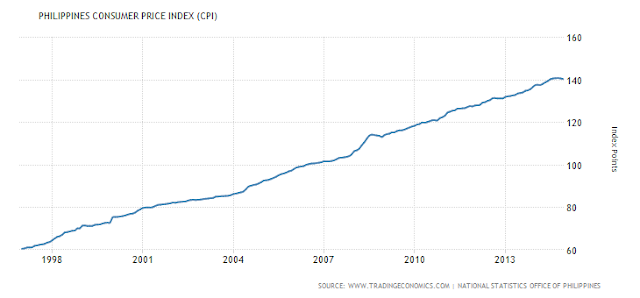

Everyone knows that, with inflation, the value of income you earned in 1997 will translate to even higher income value this 2016. For example -- your P500,000 salary in 1997 is now equivalent to about P1.1 million this 2016. In 19 years, you have become a millionaire but, in terms of "real" value, they are really just the same.

Unfortunately, the personal income tax table has remained unchanged since 1997. The taxable income values in the tax table have not been adjusted to inflation. Thus, as your income goes up with the simple passage of time, you naturally get pushed up to the higher tax bracket. No wonder your effective tax rate goes higher and higher each year!

And here's my simple wish -- that the Government, through Congress, muster the courage to correct this defect and act swiftly within the next few weeks to amend the Tax Code with the new tax table below:

There should also be a provision for the automatic indexation of the tax table against inflation to avoid the same problem in subsequent years.

With this top wish on my list, the Government will be able to increase the take-home pay of many salaried workers, including Government workers who will receive salary increases starting this year under the 2015 salary standardization law.

I continue to pray that the Government finally comes to its senses to see the truth and decide in favor taxpayers rather than technocrats, who keep on warning about budget deficits and yet underspending the budget anyway.

Wishlist #2: LOWER TAX RATES

This is not just a populist proposal. It is something that the next Congress should continue pushing for since it makes a lot of sense, especially being part of the ASEAN region. And this applies to both individual and corporate taxes.

Aside from making our country more competitive in terms of attracting foreign investments, lower tax rates will also encourage greater tax compliance among individual and corporate taxpayers.

As it is, the Philippines effectively has the highest tax rates in the ASEAN region and quite a limited number of taxpayers in the current system -- most of them, unfortunately, are mere salaried workers, like you and me.

With lower tax rates (but with a tighter system for monitoring and penalizing non-compliance), we hope to get into the "Tax Net" more and more taxpayers who ought to do their fair share in nation-building.

When we have low tax rates, we have every right to put to shame those who still refuse to pay their correct taxes -- Ibinaba na nga ang tax rates, ayaw pa ring magbayad ng tax...That is really such a disgrace!

Wishlist #3: SIMPLIFIED TAX SYSTEM

Complexity breeds non-compliance.

I personally believe that there are many Filipinos out there who would want to do the right thing and pay their taxes. Unfortunately, the current system somehow prevents them from doing so.

First, blame it on the complex Philippine Tax Code, which is largely based on the American Tax Code. It is high time that we do a comprehensive review of the Tax Code to simplify four (4) important areas:

1) Tax Types

We need to reduce and/or aggregate the many different type of taxes being imposed on taxpayers. We also need to check if certain taxes, like documentary stamps taxes, are still relevant today. This will give focus both for taxpayers and the BIR. Taxpayers will have fewer but, more significant taxes to comply with and pay for. Meanwhile, the BIR will be able to concentrate its efforts in collecting these taxes from taxpayers.

2) Exemptions and Deductions

We need to minimize and/or eliminate the various forms of exemptions and deductions. Having too many of these generous provisions in the Tax Code makes the taxpayer prone to confusion and even evasion. Paring them down or taking them out altogether will also make the BIR's job easier.

3) Frequency of tax return filings

Most of the taxes imposed under the Tax Code are required to be filed and paid on a monthly basis. This makes compliance burdensome and costly on the part of ordinary taxpayers. Administrative costs of the BIR are also higher because of this. Thus, we need to lessen the prescribed tax return filing deadlines during the taxable year.

4) Various administrative requirements

Given that we are now in a digital age, there should be more flexibility in the administrative requirements prescribed under the Tax Code, such as invoicing/receipting, bookkeeping, submission of audited financial statements and various tax reports.

These admin requirements should also not be specified under the Tax Code since we have to enact a new law just to update it. Rather, the BIR, as the tax administrator, should be given the power to prescribe most of these requirements.

However, just like any power, this power given to the BIR should be subject to certain limitations and regular review by Congress. This is an important point, especially since the current BIR administration has the tendency of making tax compliance even more difficult for taxpayers with its burdensome rules and regulations.

With the intent of catching tax evaders, the BIR sadly ends up strangling those who are already complying within the system. Meanwhile, those who would like to "legitimize" themselves to become part of the tax system get to be overwhelmed by too many requirements that they turn around disheartened, seeing that it would not be worth their time and effort in the end.

Wishlist #4: RESPECT FOR TAXPAYER RIGHTS

The Tax Code provides so much power to the Commissioner of Internal Revenue (BIR) but, there is there is nothing much on taxpayers' rights, except for taxpayer remedies in case of BIR examination and assessment.

I strongly believe that we need a Magna Carta of Taxpayer Rights (and Responsibilities, as well, to balance it off!) to provide for certain basic rights which must be accorded to taxpayers by tax authorities.

Examples of these taxpayer rights, as provided by the OECD Centre for Tax Policy and Administration, are as follows:

- The right to be informed, assisted and heard;

- The right of appeal;

- The right to pay no more than the correct amount of tax;

- The right to certainty;

- The right to privacy; and

- The right to confidentiality and secrecy.

Educating the taxpayers on their rights and providing measures to uphold these rights will help prevent abuses by tax authorities in their use of administrative powers.

Wishlist #5: FAIRER TAX SYSTEM

Last but definitely not the least, I am sure that we all dream of a fairer and more equitable tax system -- wherein those who have more in life really pay more and those who have less in life get to pay less.

There have been studies that the more fair a taxpayer perceives the tax system to be, it is more likely that the taxpayer will comply.

If we get to address the first four (4) wishlist items, then we will achieve more fairness in the current tax system. However, the system must also be re-designed to effectively tax, not only those who earn more (in terms of income), but also those who have more (in terms of wealth).

It has been noted by the World Bank that there is growing inequality in the Philippines with the wealth of the 50 richest Filipinos being equivalent to 1/4 of the country's GDP!

It is really about time that we make our tax system a tool for redistributing wealth in this country. It is not just about getting more and more collections for the Government. But, getting those increase in collections more from the wealthier taxpayers in this country, rather than from salaried workers belonging to the lower and middle-class.

------------------

With my 2016 Tax Wishlist, I sincerely hope that we will commit to support and work towards Tax Reform this year and in the years to come. Government and Congress will have much work to do but, we must also do our share.

How? By fulfilling our tax obligations as Filipino taxpayers, voicing out our concerns as Filipino citizens, and monitoring where our taxes go as our Government's bosses.

Here's to a great year for #TaxReformNow ahead of us!

No comments:

Post a Comment