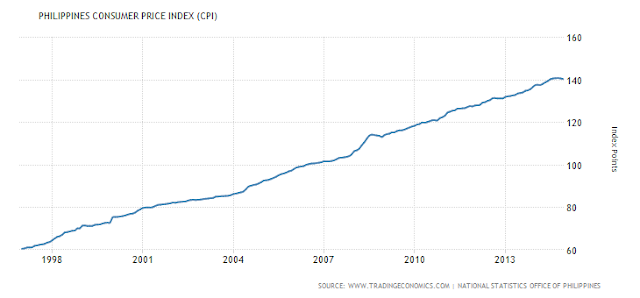

The Department of Finance (DOF) recently released to the public the inflation-adjusted income tax brackets and revised rates under its proposed tax reform package.

News reports mentioned that this will involve "the adjustment of the tax brackets to inflation, lowering of personal income tax rates to 25%, except for the highest income earners."

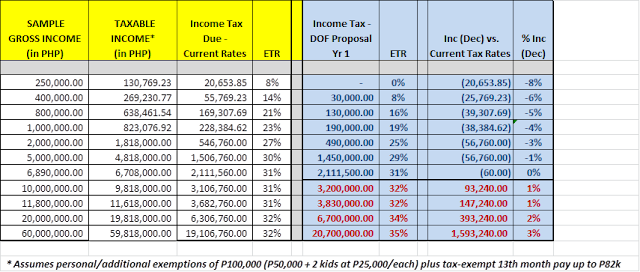

See proposed personal income tax table by the DOF below.

Offhand, it appears that those with income P250,000 and below will just be subject to a fixed tax of P2,500. Meanwhile, the proposed top taxable income threshold will now be pegged at P5M, instead of of just P500,000. However, the topmost income tax rate at this threshold will be increased from 32% to 35%.

So, what does this proposed new tax table by the DOF actually mean for YOU?

Let us find out to see if you are among those who will benefit from this proposal.

Since this is a graduated tax table and there is both a fixed and percentage component of the tax imposed, we need to first determine the Effective Tax Rate (ETR), which is the resulting tax payable expressed as a percentage of the taxable income.

A comparison of the ETR under the existing tax table versus that of the DOF proposal would show the following:

Based on this comparison, we can conclude the following:

- The biggest tax cut in terms of percentage will be for those with income of P250,000 -- i.e., at 19%.

- Those with income of P1M and below will experience a significant double-digit percentage reduction in tax rate.

- Those with income of P2M will have an ETR of 25%, which was the rate initially promised by the DOF.

- Those with income above P5M but, below P10M will have a slight reduction in tax rate.

- Those with income of P10M and above will experience an increase in ETR from the current maximum rate of 32%.

From this, we can say that, indeed, the low and middle-income earners -- i.e., those with taxable income of P2M and below, will significantly benefit from the proposed new tax table. As for those with taxable income above P2M but, below P10M, they will still benefit although, not as much. Meanwhile, those with P10M taxable income will be taxed even more.

The DOF proposal appears to be progressive and equitable since it seeks to provide relief for the low and middle-income taxpayers while, minimizing revenue losses by imposing higher tax rates on taxpayers who significantly earn the most.

However, since the DOF proposal did not disclose pertinent details yet, we would like to raise certain concerns and clarifications.

This proposal presupposes that there is no change in the personal income tax system and that existing exemptions are retained -- i.e., tax exemption for minimum wage earners and overseas Filipino workers, personal and additional exemptions?

Note, in particular, that the minimum wage earners' taxable income fall below the P250,000 income threshold which is subject to the fixed tax of P2,500.

What does the DOF mean by "lowering personal income tax rates to 25%"?

Based on the tax table, the highest tax rate will be pegged at 35% and the 25% tax rate is imposed on income in excess of P400,000 but, below P800,000. Meanwhile, the 25% ETR will be at the P2M taxable income level.

How can the proposed new tax table encourage self-employed and professionals to completely declare their taxable income and properly pay their income taxes?

Optically, it would appear to them that they will be subject to income tax from 20% to 35% tax rates. With them realizing the actual ETR, they may get discouraged and remain averse to declaring their true income.

Note that, the TMAP Proposal (which was discussed in this blogsite previously) indicated a P300,000 tax-exempt threshold, which already covers all existing exemptions in order to simplify administration and compliance. This will also help minimize the revenue losses since the existing exemptions are already factored-in prescribing said tax-exempt threshold. More importantly, this would optically show lower tax rates in the income tax table, which will help encourage the self-employed and professionals to declare their true taxable income.

Why is the top individual tax rate of 35% higher than that of the proposed reduced corporate income tax rate of 25%? Would not this just lead to individuals incorporating themselves in order to avail of the lower tax rate?

There are countries wherein the individual tax rate is higher than those of corporations. Meanwhile, there are those countries which ensure parity between individual and corporate tax rates to avoid any differentiation.

Note that, in the Philippines, individual shareholders of corporations get to be hit twice by income taxes -- one via corporate income tax and the other via dividend final withholding tax, which is at 10%. It could be that the DOF considered the 35% top rate for individual taxpayers to level-off the taxes imposed on individual shareholders -- i.e., 25% corporate income tax plus 10% dividend income tax. The 35% tax rate will also make the Philippines at par with Vietnam in terms of having the highest personal income tax statutory rate in the ASEAN region.

Maybe this is something that the DOF can still look further into. It somehow needs to balance the need to minimize revenue losses and the impact of lower tax rates in encouraging tax compliance.

Despite the foregoing, we can say that the DOF proposal is one great initial step in making the personal income tax system more progressive and equitable. While it will hurt those with income of P10M and above, the low and middle-income taxpayers will benefit most from it. It will also be good if it considers optically lowering the tax rates to encourage greater tax compliance, especially among self-employed and professionals.

At this point, we, taxpayers, are definitely looking forward to knowing more about the details of the DOF's comprehensive tax reform package, which will hopefully result, not only to lower income tax payments but also better lives through greater consumption or savings.